Insurance Company SEO Services

That Drive Local Policy Enquiries and Qualified Leads

Led by experienced insurance SEO specialists, our strategies are built around buyer intent, local search visibility, and the regulatory realities of competitive insurance markets.

Who This is For

Our Insurance Company SEO services are built for insurance businesses that need consistent local visibility to generate more high-intent policy enquiries, attract qualified prospects, and reduce long-term reliance on paid advertising. This service is ideal for independent insurance agencies, multi-location insurance firms, and specialist providers that compete in local and regional markets and rely on steady enquiry volume to grow their client base. Rather than functioning as a static brochure, your website is developed into a reliable enquiry-generation asset designed to support long-term business growth.

This solution is best suited for insurance businesses ready to invest in sustainable SEO growth to achieve stronger rankings for high-intent insurance keywords, improve local search visibility, and increase enquiry conversion rates across core services such as auto, home, life, health, and commercial insurance. If your objective is to turn organic search traffic into qualified policy enquiries, booked consultations, and predictable long-term customer acquisition, our Insurance Company SEO strategy is designed to support that outcome.

Independent Insurance Agencies

Serving local or regional markets and providing personalised insurance solutions within defined service areas.

Specialist Insurance Providers

Offering life, health, auto, home, or commercial insurance services within targeted local or regional markets.

Multi-Location Insurance Firms

Operating across multiple locations and requiring scalable local SEO strategies to compete in Google Maps and organic search.

Established Insurance Companies

Looking to strengthen organic visibility, increase qualified policy enquiries, and reduce long-term reliance on paid advertising.

What is INSURANCE SEO

Insurance SEO is the process of improving an insurance website’s visibility in search engines so potential policyholders can find your services when actively searching for coverage.

High-Value Keywords

Optimizes for high-value transactional keywords

Local Search Intent

Targets local and service-based search intent.

Conversion Focus

Focuses an conversion-focused user journeys.

Trust & Authority

Prioritizes building online authority and trust, using local and legal-specific signals.

How INSURANCE SEO Works

Insurance SEO is not a single tactic. It is a structured, ongoing process that builds sustainable visibility, authority, and consistent policy enquiries over time.

01

Market & Competitor Analysis

The process begins with detailed market research to identify your target service areas, insurance products, and the search behaviours of potential policyholders. This includes analysing local demand, search intent, and keyword opportunities across core insurance services such as auto, home, life, health, and commercial insurance. The goal is to ensure your SEO strategy is aligned with how prospective customers actively search for insurance coverage in your market.

Alongside this, a comprehensive competitor analysis is carried out to assess how other insurance agencies and providers are performing in organic and local search. This involves reviewing competitor keyword targeting, content depth, local SEO strategies, backlink profiles, and Google Maps visibility. These insights are used to identify gaps, define realistic growth opportunities, and position your insurance website to compete effectively for high-intent search terms.

t

02

t

Technical & On-Page Optimization

Technical and on-page optimization is a foundational stage of insurance SEO, ensuring your website performs efficiently for both search engines and users. This phase focuses on improving site speed, mobile usability, crawlability, and indexation, while addressing technical factors that can limit search visibility or user experience.

On-page elements are refined across key pages, including page titles, headings, internal linking, URL structure, and service content. Insurance-specific pages are optimized to clearly reflect search intent, improve relevance, and support conversion. These improvements help search engines understand your website more effectively while providing a faster, clearer experience for potential policyholders.

03

Local SEO & Google Business Profile Optimization

Local SEO is critical for insurance agencies that serve customers within defined geographic areas. This stage focuses on improving visibility in local search results and Google Maps, where high-intent insurance searches frequently occur. Your Google Business Profile is fully optimised with accurate business information, insurance services, service areas, and regular updates to strengthen relevance and trust.

Local citations across trusted insurance, business, and local directories are built and refined to ensure NAP consistency. Where appropriate, location-based service pages are created or optimised to target key cities or regions. These actions improve local authority and increase the likelihood of appearing in the map pack when potential policyholders search for insurance services nearby.

t

04

t

Insurance-Specific Content Development

Insurance-specific content development focuses on creating high-value service pages, blog content, and educational guides that address how potential policyholders actively search for insurance coverage. Content is planned around relevance, search intent, and accuracy, ensuring each page clearly reflects the services offered while building trust and credibility within a regulated industry.

Once content opportunities are identified, topics are mapped strategically across the website. Informational content supports early-stage research and education, while commercial and service-focused content targets high-intent insurance searches. This structured approach ensures every page serves a clear purpose, supports organic visibility, and guides users toward meaningful policy enquiries rather than passive traffic.

05

Authority Building & Trust Signals

High-quality insurance content is developed to demonstrate expertise, address common policyholder questions, and support long-term keyword rankings. This includes service pages, insurance-specific guides, FAQs, and educational content written in accurate, compliant language that reflects industry standards. Content is structured to be both search-engine friendly and easy for users to understand, reinforcing trust at every stage of the customer journey.

Authority building is strengthened through ethical backlink acquisition from reputable insurance, financial, and business publications, as well as relevant industry sources. These backlinks act as trust signals for search engines, supporting stronger rankings while reinforcing your insurance business’s credibility, expertise, and authority online.

t

06

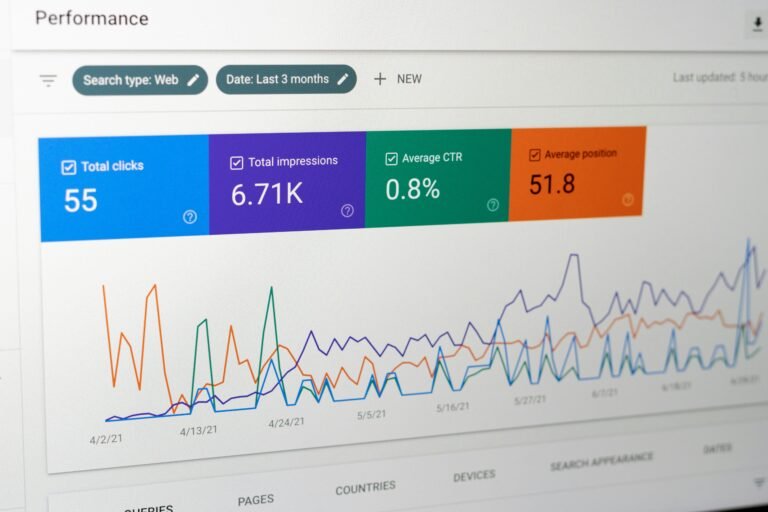

Performance Tracking & Refinement

SEO performance is continuously monitored using data from analytics and ranking tools to track the effectiveness of your insurance SEO strategy. Key metrics such as keyword rankings, organic traffic, local search visibility, user behaviour, and policy enquiry conversions are measured to assess progress and identify trends.

Regular reporting provides clear, actionable insights into what is performing well and where refinements are needed. Strategies are adjusted over time based on performance data, algorithm updates, and changes in insurance search behaviour. This ongoing optimisation helps ensure your insurance business remains competitive and continues to generate consistent, high-quality policy enquiries from organic search.

t

Our INSURANCE COMPANY SEO Strategy

We use a multifaceted SEO strategy built specifically for the insurance industry. Our approach goes beyond basic optimization to deliver ethical, compliant, and sustainable results for insurance companies.

Technical SEO for Insurance Websites

- Crawlability and indexation

- Core Web Vitals optimization

- Secure site architecture

- Mobile-first usability

Local SEO for Insurance Agencies

- Google Business Profile

- Location-based service pages

- Local citations and NAP consistency

- Review strategy and reputation signals

On-Page SEO for Insurance Services

- Auto insurance

- Home insurance

- Life insurance

- Health insurance

- Commercial insurance

Content and Authority Building

- Expert-led service content that demonstrates subject-matter expertise

- Location-specifie landing pages designed to capture local search intent

- Ethical backlink acquisition from relevant, authoritative industry sources: EE-AT )

What results can you expect from INSURANCE SEO

Insurance SEO is a long-term strategy focused on building visibility through demonstrable expertise, authoritative content, and trust signals, resulting in sustained organic growth and a consistent flow of high-intent policy enquiries.

3-4 Months

Improved local and organic rankings

- Stronger local and organic search visibility

- Improved visibility across local and organic search results

- Higher local and organic search rankings

4-6 Months

Increased enquiry volume

- Increase in qualified enquiries

- Higher volume of insurance enquiries

- More consistent enquiry generation

6-12 Months

Stronger local authority

- Established authority across core service and location searches

- Reduced dependence on paid advertising for patient acquisition

- Sustainable, long-term growth driven by organic and local search

Insurance SEO FAQs

What is insurance company SEO?

Insurance SEO improves an insurance website’s visibility in search engines so potential customers can find insurance services when actively searching online.

How is insurance SEO different from general SEO?

Insurance SEO requires stronger trust signals, local intent optimization, and strict compliance with Google’s Your Money or Your Life(YMYL) standards.

How long does insurance SEO take to work?

Initial improvements usually appear within 3–4 months, with meaningful enquiry growth between 6–12 months.

Does SEO work for small insurance agencies?

Yes. Local SEO allows smaller agencies to compete effectively within defined service areas.

Is insurance SEO ethical and compliant?

Yes. Ethical insurance SEO avoids misleading claims, fake reviews, and manipulative tactics.

Is insurance SEO worth it?

For most agencies, insurance SEO delivers high-intent traffic, long-term visibility, and reduced reliance on paid ads.

Does insurance SEO help with Google Maps rankings?

Yes. Insurance SEO plays a critical role in improving Google Maps and local pack visibility by optimising your Google Business Profile, local citations, reviews, and location-based service pages.

Can insurance SEO generate phone calls and quote requests?

Yes. When implemented correctly, insurance SEO targets high-intent searches, leading to more phone calls, contact form submissions, and quote requests from organic traffic.

Is insurance SEO suitable for multi-location insurance firms?

Yes. Insurance SEO strategies can be scaled across multiple locations using location-specific landing pages, Google Business Profiles, and local authority signals for each service area.

What types of insurance benefit most from SEO?

SEO is effective for most insurance services, including auto, home, life, health, and commercial insurance, particularly where customers actively compare providers online.

How competitive is insurance SEO?

Insurance SEO is highly competitive in most markets. Success depends on local authority, content quality, technical performance, and long-term strategy rather than quick fixes.

Does insurance SEO require ongoing work?

Yes. Insurance SEO is an ongoing process that involves continuous optimisation, content updates, performance tracking, and adaptation to algorithm changes.

Can insurance SEO replace paid advertising?

Insurance SEO does not replace paid advertising immediately, but over time it can significantly reduce reliance on paid ads by delivering consistent organic enquiries.

What makes insurance SEO YMYL-compliant?

YMYL-compliant insurance SEO focuses on accuracy, transparency, expert-led content, and trust signals rather than aggressive sales language or manipulative tactics.

Should insurance agencies publish blog content for SEO?

Yes. Informational content helps support E-E-A-T, build topical authority, and capture early-stage search demand that feeds into high-intent service enquiries.

Is there a risk of penalties with insurance SEO?

Only if unethical tactics are used. White-hat insurance SEO follows Google guidelines and avoids practices such as spammy backlinks, keyword stuffing, or fake reviews.

How do you measure success in insurance SEO?

Success is measured through improvements in local and organic rankings, enquiry volume, conversion rates, and reduced cost per acquisition over time.

Is insurance SEO different for local vs national providers?

Yes. Local insurance SEO focuses on geographic visibility and service areas, while national strategies prioritise broader authority, content depth, and brand trust signals.

LATEST BLOG POSTS